The content displayed below is for educational and archival purposes only.

Unless stated otherwise, content is © Watch Tower Bible and Tract Society of Pennsylvania

You may be able to find the original on wol.jw.org

REGIONAL BUILDING COMMITTEE

ACCOUNTING MANUAL

June 1, 2007

RegionalBuildingCommitteeAccountingManual (S-100-E)

Table of Contents

Chapter Paragraphs

1. ACCOUNTING PROCEDURES

Disbursements From the Checking Account

Watchtower Credit Card Program

Accounting for Sales and Use Tax

-

4. AUDITING AND RECORDS

Audit of Kingdom Hall Building Fund Accounts

-

5. FORMS FOR REGIONAL BUILDING COMMITTEE RECORD KEEPING

Contribution Acknowledgment Letter

Accounts Sheet (S-26)

CategoryExpenseSheet(S-90)

Loan/Receivable Ledger (S-92)

Monthly ReporttoCongregation—KingdomHallBuildingFund (S-93)

Payment Voucher (S-94)

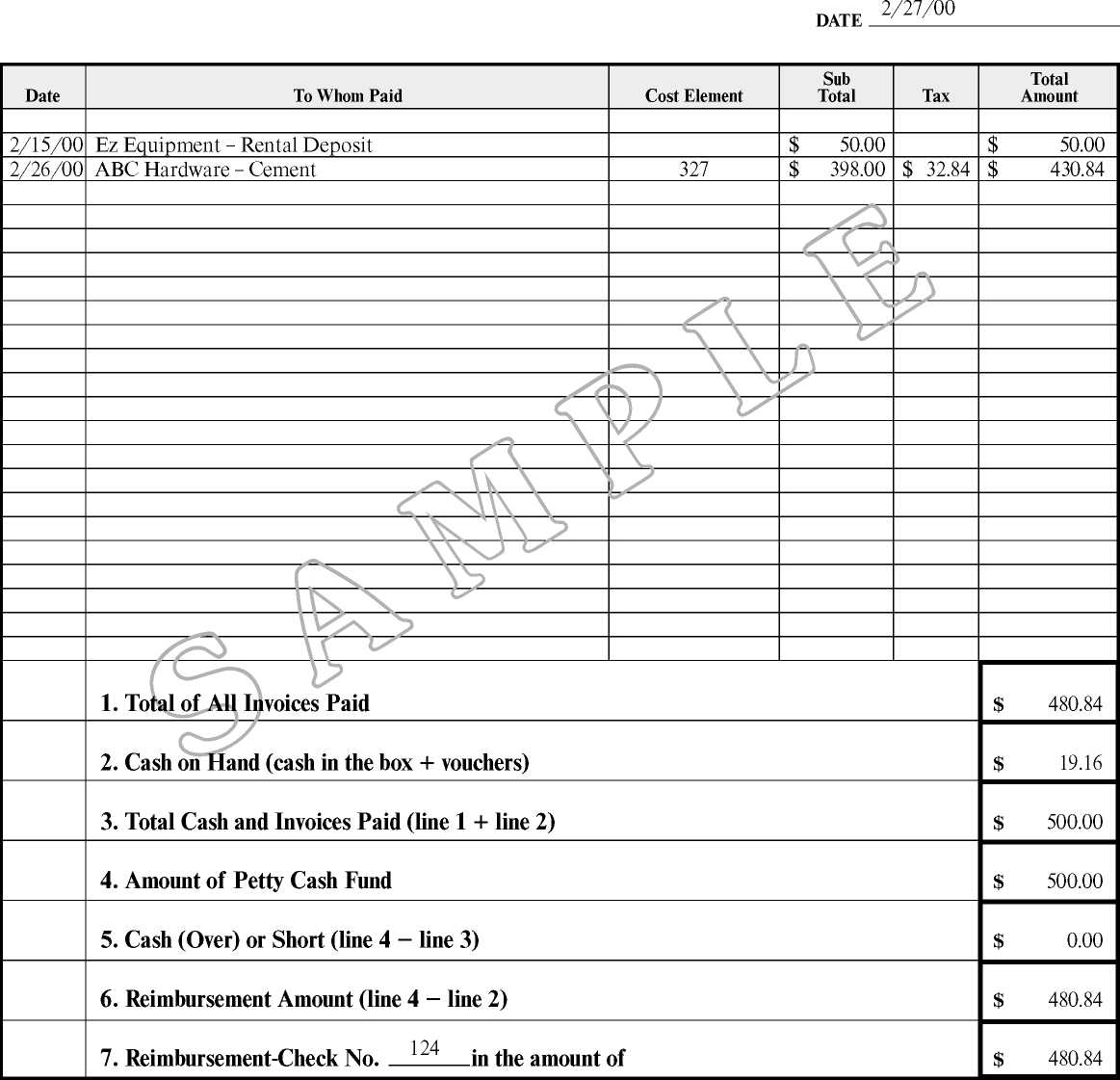

PettyCashReimbursement(S-95)

ReceiptsJournal—KingdomHallBuilding Fund (S-96)

-

Chapter One

Accounting Procedures

PROJECT ACCOUNTING OVERSEER

-

1. When a Kingdom Hall construction project is first proposed and a building fund is established, the Regional Building Committee will appoint a project accounting overseer. He may be assisted by one or more local elders or ministerial servants.

-

2. The project accounting overseer will coordinate the accounts for the Kingdom Hall project. This brother should have basic office skills. He will be expected to oversee the maintenance of the checkbook and all records of receipts and disbursements for this account. Thus, the regional committee may request that their project accounting overseer obtain the building account checkbook. An appointed member of the regional committee should approve all expenditures in advance by approving a Payment Voucher (S-94). Or, all checks should be signed by either a regional committee member or the committee’s appointed project coordinator and be countersigned by an authorized local elder. Whichever arrangement is used, all expenditures should be approved by an appointed member of the Regional Building Committee, and all checks should have two signatures. Each month, the involved congregation(s) should be given a full report of expenditures from this account. Funds should not be taken from this account without prior approval from a member of the Regional Building Committee or their project coordinator. Every effort should be made to have the project account closed within 60 days of the conclusion of the project and to forward the Report on Kingdom Hall Construction Project (S-85) to the branch office promptly.

ACCOUNTING SYSTEM

-

3. The records used to accumulate the project costs can, if necessary, be maintained with a hand-posted system. If a computer program is available, it may be more efficient to use it to maintain the records because of the large amount of detail required.

-

4. Whatever accounting system is used should make it possible to accumulate the disbursements of each project in sufficient detail so that the List of Major Cost Elements (S-84a) can be completed for submission to the branch office at the conclusion of the project. This form compares the budgeted costs by category with the actual costs of the project.

RECORDS

-

5. The project accounting overseer will maintain the permanent records listed below. (If any of these are produced with computer programs, the records should be produced in a format similar to the form provided

by the branch office and a hard copy should be printed out at the end of each month and placed in the permanent file.)

-

• Completed and signed Receipt (S-24) forms

-

• Receipts Journal (S-96)

-

• Promissory note and Loan/Receivable Ledger (S-92) for each loan to the project

-

• Copies of acknowledgment letters for contributions

-

• Checkbook

-

• Bank statements and canceled checks

-

• Payment Vouchers (S-94) with corresponding paid invoices, purchase orders, and receiving documents

-

• Petty Cash Reimbursement (S-95) forms with corresponding paid invoices

-

• Monthly bank reconciliation

-

• Monthly Report to Congregation—Kingdom Hall Building Fund (S-93)

-

• Kingdom Hall Building Fund Audit Reports (S-91)

-

• List of Major Cost Elements (S-84a)

-

• Monthly Category Expense Sheets (S-90)

-

• Monthly Accounts Sheets (S-26)

STARTING AN ACCOUNT

-

6. After the written agreement between the congregations involved in the project has been signed, the congregation elders should open a separate checking account in the name of the congregation holding title to the property. The sole purpose of this account is to receive and disburse funds for the building project. The funds needed to pay for the expenses of the project may come from the following sources:

-

• Transfers from existing congregation checking or savings bank accounts

-

• Proceeds from the sale of an existing Kingdom Hall

-

• A loan received from the branch office

-

• Loans from others

-

• Donations from individuals or congregations (Congregations may provide contribution boxes for donations to the building fund.)

RECEIPTS

-

7. When funds are received, either as cash or checks or in some other way, the project accounting overseer or his local representative, witnessed by a second brother, will prepare a Receipt (S-24) in duplicate. Receipts will be numbered consecutively starting with number 1. The original receipt will be kept by the project accounting overseer or his local representative and filed as supporting documentation for the deposit slip when the funds are deposited in the bank. The duplicate will be given to the chairman of the Regional Building Committee, who will hold it until the next audit of the building project accounts. The local body(ies) of elders will select capable elders to perform the quarterly audits of the accounts.

-

8. Receipts are to be recorded daily in the Receipts Journal (S-96) by receipt number and date. Each month, total the receipts by column and then post the total to the “Receipts-In” column on the Accounts Sheet (S-26). Until all receipts (checks, currency, or coin) are deposited in the bank, they should be kept in a secure location, such as a safe, lockbox, locked drawer, or locked closet.

DEPOSITS TO CHECKING ACCOUNT

-

9. For good internal controls, it is important to deposit contributions and other receipts as quickly as possible, especially large amounts of currency. Accordingly, the project accounting overseer should endeavor to have all deposits made within two business days after receipt or at least once per week. Entry is to be made in the Receipts Journal (S-96) for each deposit made, with the amount of the deposit indicated in the “Totals-Out” column. The Receipt (S-24) forms should be stapled to the deposit slip and maintained in the permanent file. Each deposit should also be recorded in the checkbook register. The total deposits for the month are posted from the Receipts Journal to the “Receipts-Out” and “Checking Account-In” columns on the Accounts Sheet (S-26).

DISBURSEMENTS FROM THE CHECKING ACCOUNT

-

10. Whenever possible, purchases of material and other expenditures should be made by either check or a credit card approved by the branch office. (See paragraphs 12-15.) All checks require the signatures of two brothers. Several brothers should be authorized as signers, and the brothers selected should be readily available. A member of the Regional Building Committee or their project coordinator must be one of the two signers on each check. The checking account should be interest bearing if possible.

-

11. For each bill that is paid, a Payment Voucher (S-94) should be completed. Each disbursement is coded to one or more of the major cost elements and subelements as outlined on the List of Major Cost Elements (S-84a). The original invoice, a copy of the purchase order (where applicable), and some documentation proving that the material or service has been delivered is to be stapled to the Payment Voucher. The Payment Voucher is to be approved by a member of the Regional Building Committee. He should confirm the major cost element codes entered on the Payment Voucher. As checks are written, the transactions are recorded in the checkbook register. When using a hand-posted system, post the transactions from the payment vouchers to the appropriate Category Expense Sheets (S-90) each day. Use new sheets for each month. Carry forward the balance in the “Cumulative” column to the next month’s Category Expense Sheet for each category. At the end of each month, total the “Checking” column for each Category Expense Sheet and post the total to the “Checking Account-Out” column on the Accounts Sheet (S-26).

WATCHTOWER CREDIT CARD PROGRAM

-

12. The United States branch office has set up a credit card program for use by Regional Building Committees. The credit cards are issued by JPMorgan Chase and carry the MasterCard logo. They can be used wherever MasterCard is accepted. Watchtower receives a rebate for all purchases on these cards. Directives regarding this program are outlined in the Watchtower Purchasing Card Program Policies and Procedures for Regional Building Committees and Watchtower Purchasing Card Program Cardholder User Manual for Regional Building Committees.

-

13. The Regional Building Committee can request credit cards through the Treasurer’s Office by using the RBC Credit Card Account Application. Credit card requests are project specific. The Regional Building Committee appoints an elder in their finance/accounting department as the credit card coordinator for the project. The RBC Credit Card Account Application is composed of two work sheets. The first work sheet requests information about the project and contact information for the project credit card coordinator and an assistant. The second work sheet asks for information necessary for requesting a card in the name of a volunteer who will be purchasing materials for the project.

-

14. All credit card activity for a specific project is reflected on one central billing account. JPMorgan Chase will automatically debit the local building fund checking account to pay the monthly central billing account statement. Therefore, it will be necessary to send to the Treasurer’s Office the banking information for the local building fund account using the ACH Debit/Credit Authorization Agreement for RBC Credit Card Program and a photocopy of a check from the account. The Treasurer’s Office will set up the automatic payment with JPMorgan Chase Bank.

-

15. The project credit card coordinator and his assistant(s) are responsible for processing all paperwork associated with a project’s credit cards and monitoring credit card transactions for all cards assigned to a project. These brothers are the first line of defense against any fraudulent activity, should this occur. The project credit card coordinator’s duties require access to the Internet. Computers used should have adequate virus and spyware protection.

PETTY CASH

-

16. Certain disbursements, usually smaller amounts, are conveniently paid in cash. With good planning, these disbursements will be kept to a minimum. To handle such small payments, the local building committee should establish a petty cash fund, which will be administered and controlled by the project accounting overseer. However, the project coordinator should possess the petty cash box until the building project actually begins. Since there is a risk in keeping cash on hand, the Regional Building Committee can provide guidance as to the amount of petty cash that should be maintained. The following procedures are provided as a guide to handling disbursements and replenishing the petty cash fund:

-

• To establish the petty cash fund, a check is written payable to the brother who will be responsible for the fund. He will cash the check at the bank for the amount authorized. When the check is recorded in the checkbook register, the amount is recorded as a transfer from the checking account to petty cash. After the check is cashed, the cash is placed in a lockable cash box, which can be obtained from a local office-supply store. The “Other” column on the Accounts Sheet (S-26) can be used to keep account of the petty cash. Record the check amount in the “Checking Account-Out” and “Other-In” columns.

-

• When someone is sent to a store to purchase material or supplies for the project, he may obtain an advance from petty cash to pay for the approved purchases. When he is given the cash from the box, a petty cash voucher (which can be purchased from a local office-supply store) is completed. The petty cash voucher should contain an explanation of the type of material to be purchased, the amount advanced, and the signature of the brother who received the advance. This voucher is then kept in the petty cash box.

-

• When the brother returns with the material, the paid invoice (often referred to as the receipt received from the store) for what was purchased and any unused cash from the advance is placed in the petty cash box. The petty cash voucher that was previously prepared is returned to him or is torn up in his presence. The amount of the paid invoice should be clearly shown, and the cost element(s) to which the disbursement is to be charged should be noted on the paid invoice.

-

• At all times, the sum of (1) the cash in the petty cash box, (2) the paid invoices in the petty cash box, and (3) the petty cash vouchers in the petty cash box should equal the amount of the petty cash fund as it was established by the local building committee.

-

17. As the petty cash is reduced by spending, it will be necessary to replenish the fund. To replenish the petty cash fund, the project accounting overseer should see to the following:

-

• Sort all paid invoices by major cost element and subelement, and then enter each paid invoice in the Petty Cash Reimbursement (S-95) form.

-

• Count the actual cash remaining in the petty cash box plus the outstanding petty cash vouchers in the petty cash box. Enter the total on the Petty Cash Reimbursement form in the space provided.

-

• Total the amount of paid invoices, any outstanding petty cash vouchers, and the cash on hand. Deduct this figure from the approved amount of the petty cash fund, and enter the difference in the line labeled “Cash (Over) or Short.” If the amount is over, it should be entered as a minus. If the amount is short, it isa plus. A cash overage or shortage would be recorded to a miscellaneous administrative cost category.

-

• Add this amount to the total of paid invoices on hand, and enter the total in the “Reimbursement-Check No__” line. A check for

this amount may then be written payable to the brother responsible for the petty cash fund. He will replenish the petty cash fund.

-

• The paid invoices are to be stapled to the Petty Cash Reimbursement form as support for the reimbursement check.

-

• After the check is cashed and the cash is placed in the petty cash box, the total cash on hand in the petty cash box (cash plus vouchers) should equal the amount of the petty cash fund.

-

• The reimbursement check is recorded in the checkbook register in the same manner as all other checks.

-

• Post the transactions from the Petty Cash Reimbursement form to the appropriate Category Expense Sheets (S-90). At the end of each month, total the “Petty Cash” column for each Category Expense Sheet and post to the “Other: Petty Cash-Out” column on the Accounts Sheet.

BANK RECONCILIATION

-

18. For internal control purposes, we recommend that the monthly bank statements be mailed directly to a member of the Regional Building Committee. Upon receipt, he should review the statement for unusual items and review the canceled checks (if available) to see that all checks are properly signed with authorized signatures and that checks have been written to familiar vendors, suppliers, and so forth. After this review, the bank statement and canceled checks should be forwarded promptly to the project accounting overseer or his local representative. The bank account is to be reconciled to the statement received from the bank at the end of each month. The bank statements, returned checks, voided checks, and the bank reconciliation are retained in the permanent file.

REPORTS

-

19. The project accounting overseer will prepare or designate someone to prepare the following reports:

-

• Monthly Report to Congregation—Kingdom Hall Building Fund (S-93)

-

• List of Major Cost Elements (S-84a) completed at the end of the project, although this report may be prepared monthly or at other intervals for use in preparing the Monthly Report to Congregation and/or to keep the local bodies of elders and the Regional Building Committee informed of the financial progress of the project

ACCOUNTING FOR SALES AND USE TAX

-

20. Each state is different when it comes to providing exemption from sales and use tax on materials used in the construction of a Kingdom Hall. Some states do not provide tax exemption. Some states provide exemption at the time of purchase. Others require that the tax be paid at the time of purchase and then an application be made for a tax refund. Each Regional Building Committee must become familiar with the legal requirements for the states in which they build and should be sure to follow all regulations so that unnecessary tax is not paid.

-

21. In states where exemption is made at the time of purchase, it is usually necessary to provide the vendors with a state tax exemption certificate or number so that the tax is not charged. Because there is no tax charged, there is no need to account for the tax.

-

22. In states where there is no tax exemption, tax is charged on each transaction. In this case, the tax can be viewed as a cost of doing business in that state and there is no need to account for the tax separately. The tax is simply included in the cost of each item and charged to the appropriate major cost element and subelement. Since the tax on each item is usually combined and reported as one amount on receipts or invoices from vendors, it may be easier to account for the tax separately. The cost of each item is entered on the Payment Voucher (S-94) and charged to the appropriate major cost element and subelement while the tax is recorded as a tax expense (category 722). It will be the responsibility of the project accounting overseer to decide how to handle recording the tax.

-

23. In states where the tax is paid at the time of purchase and application is later made for a tax refund, the tax must be recorded separately from the cost of each item. The cost of each item is entered on the Payment Voucher or Petty Cash Reimbursement (S-95) form and charged to the appropriate major cost element and subelement, while the tax is recorded as a tax “Refund Receivable” (category 140). At the end of the project (or whatever frequency is practical and the state allows), the appropriate application and documentation should be filed with the state to receive the refund. When the refund check is received, it is recorded in the “Other” column of the Receipts Journal (S-96). Keep a record of the refund receivable by using a Loan/Receivable Ledger (S-92). Post the amount of the tax refund receivable from each Payment Voucher or Petty Cash Reimbursement form to the “Out” column of the ledger and adjust the balance accordingly. Also, post the monthly total to the

“Checking Account-Out” or “Other: Petty Cash-Out” column of the Accounts Sheet (S-26). When the refund is received, it should offset the amount that has been accumulating on the Loan/Receivable Ledger. Enter the refund amount in the “In” column of the ledger and adjust the balance accordingly. Similarly, the refund amount should be recorded on the Accounts Sheet in the “Checking Account-In” column.

DEPOSITS

-

24. When renting equipment for use during a project, often the vendor will require a security deposit to be paid. This is refunded when the item is returned. This amount should be recorded on the Payment Voucher (S-94) or Petty Cash Reimbursement (S-95) form as a “Deposit Receivable” (category 130). When the deposit is returned, it is recorded in the “Other” column of the Receipts Journal (S-96). Keep a record of the deposit receivable by using a Loan/Receivable Ledger (S-92). Post the amount of the deposit receivable from the Payment Voucher or Petty Cash Reimbursement form to the “Out” column of the ledger and adjust the balance accordingly. Also, post the amount to the “Checking Account-Out” or “Other: Petty Cash-Out” column of the Accounts Sheet (S-26). When the deposit is returned, enter the amount in the “In” column of the ledger and adjust the balance accordingly. The same principles apply for other types of refundable deposits, such as utility deposits, deposits with governmental agencies for plan checking, inspections, zoning reviews, permits, and performance bonds.

DONATED MATERIAL

-

25. At times, brothers working on the project or others may supply materials or other items and do not wish to be reimbursed for the cost. This is greatly appreciated, and there is no need to account for this material if it is of minimal value. However, for larger donations the cost of the material must be accounted for so that the true cost of the project is reported. Therefore, if the value of donated material from any single source exceeds $1,000, the value should be recorded in the books. For example, if a brother provides $400 worth of lumber on three separate occasions, the total value of $1,200 must be accounted for. When requested, the donor should also receive an acknowledgment letter from the local elders.

-

26. The department overseers will be responsible for determining a fair market value for any donated material and will inform the project accounting overseer in writing of the value if the $1,000 limit is exceeded. The budget can be used to determine the value of donated material if it was an item that was originally planned as a purchase. The project accounting overseer will then record the value as a “Receipt-Donated Materials” (category 241) and apply the value to the proper major cost element and subelement. Simply enter the value of the donated material in the “Donated” column of the appropriate Category Expense Sheet (S-90).

Account Categories

INCOME

-

1. Income categories would usually include the following:

200 Beginning Funds From Congregations

210 Proceeds From Sale of Kingdom Hall

220 Loan From Branch Office

230 Loans From Others

240 Donations

250 Other Income

-

2. Two other income categories that might be used, depending on local circumstances, are Donated Materials (category 241) and Interest Income (category 251). These accounts may need to be set up when using computer accounting programs.

EXPENSE

-

3. Expense categories can be found on the List of Major Cost Elements (S-84a). These account categories and corresponding account numbers should be used, regardless of the accounting system employed.

OTHER

-

4. Some computer accounting programs require that balance sheet accounts be set up when using the program. Below are some accounts that may be used, depending on local circumstances. These are only suggestions and can easily be modified to fit each particular computer program.

Assets

-

110 Cash in Bank

120 Petty Cash

130 Deposits Receivable

140 Refunds Receivable

Liabilities

150 Loan From Branch Office

160 Loans From Others

Net Assets

170 Congregation Net Assets

Budgeting and Application for Financial Assistance

-

1. A budget should be prepared in detail by major cost element. (See List of Major Cost Elements (S-84a) for the major cost elements to be used.) The Regional Building Committee can use the List of Major Cost Elements to prepare the budget for the project, or the budget can be prepared using a computer program. However, even if a computer program is used, the final accounting should be shown on the List of Major Cost Elements provided by the branch office. Cost elements should be estimated as accurately as possible without adding a general “contingency” to the overall project cost. While previous projects can provide a baseline cost, each budget should be carefully reviewed prior to release to ensure that it is complete and accurate and that all materials are being purchased at competitive prices. Copies of the detailed budget should be (1) kept in the Regional Building Committee files and (2) given to the local building committee so that the local elders can inform the congregation(s) of the budget and pass resolutions to authorize the project.—km 8/03 p. 4 par. 9.

-

2. After the budget has been prepared and the local congregations have passed the needed resolutions, the local building committee will work with the service committee of each congregation involved in the project and the Regional Building Committee to prepare the Kingdom Hall Loan Application (S-84) if the congregations are applying for a loan from the Kingdom Hall Fund. Copies of this completed form should be retained by each congregation involved and by the Regional Building Committee.

-

3. Copies of the resolutions authorizing the project should be provided to the Regional Building Committee so that the project can be scheduled. However, if a loan is being requested from the Kingdom Hall Fund, do not proceed with any Kingdom Hall construction until the application is submitted and the final loan approval is received. (Please see paragraph 4 of the letter to all bodies of elders of congregations applying for a loan from the Kingdom Hall Fund (S-101).) However, once the site plan and building location are approved by the Regional Building Committee, work may proceed with general excavation and site work, including septic and water service. This should not include foundation or slab work, as that would limit the building’s size and would entail great expense if a later review of the proposal suggests making some adjustments. Work

Budgeting and Application For Financial Assistance

may also begin on obtaining the permits and competitive bids for materials.

LOANS FROM OTHERS

-

4. It is necessary to keep good records of all loans received and to put all loans down in writing to avoid misunderstandings. A promissory note should be provided for each loan received. For small loans, the repayment terms might simply be “on demand.” However, it is unwise to accept large amounts on these terms. It is better to negotiate definite terms with the lender so that repayments can be properly planned.

-

5. Loans must be paid by contributions received in the future. The amount of regular contributions received is really what determines how much money can be borrowed so that repayment obligations can be met.

-

6. A Loan/Receivable Ledger (S-92) should be completed for each individual providing a loan. This is a record of all transactions with the individual providing the loan. Column 1 shows the date of each transaction; column 2 is the description of the transaction; and columns 3, 4, and 5 list the amounts received, repaid, and the balance. If interest is paid, it is calculated at agreed-to intervals and added to the loan by entering it in column 3. The balance in column 5 is adjusted accordingly. When repayments are made, these are entered in column 4 and the balance in column 5 is adjusted. If this same individual makes additional loans, a new entry is made and the balance adjusted.

-

7. Loan repayments are made from regular congregation contributions and not from the building fund.

Auditing and Records

AUDIT OF KINGDOM HALL BUILDING FUND ACCOUNTS

-

1. The Kingdom Hall building fund accounts are to be audited quarterly for the quarters ending November 30, February 28 (29), May 31, and August 31. Elders, preferably with some bookkeeping or accounting experience, should be chosen by the bodies of elders to audit the Kingdom Hall building fund accounts.

-

2. The procedures for this audit are provided on the Kingdom Hall Building Fund Audit Report (S-91). When the audit has been completed, each body of elders involved in the project should receive a copy of the audit and an announcement should be made to the congregations that the audit was completed.

RECORDS

-

3. The Regional Building Committee will maintain a file for each project with the following documents in the file (depending on the status and nature of the project):

-

• Project budget prepared on the List of Major Cost Elements (S-84a)

-

• Copy of the completed Kingdom Hall Loan Application (S-84) if a loan is requested from the Kingdom Hall Fund

-

• Copies of the congregation resolutions approving the project

-

• Final completed List of Major Cost Elements

-

• Regional Building Committee Report on Construction Project

(S-85)

Forms for Regional Building Committee Record Keeping

The forms listed below have been prepared by the branch office for use by the Regional Building Committees and/or the congregations.

-

• Accounts Sheet (S-26)

-

• Kingdom Hall Loan Application (S-84)

-

• List of Major Cost Elements (S-84a)

-

• Regional Building Committee Report on Construction Project (S-85)

-

• Category Expense Sheet (S-90)

-

• Kingdom Hall Building Fund Audit Report (S-91)

-

• Loan/Receivable Ledger (S-92)

-

• Monthly Report to Congregation—Kingdom Hall Building Fund (S-93)

-

• Payment Voucher (S-94)

-

• Petty Cash Reimbursement (S-95)

-

• Receipts Journal—Kingdom Hall Building Fund (S-96)

Chapter Six

Sample Forms

-

1. Sample forms have been prepared to illustrate how to record transactions using the forms referred to in this manual. The samples are not intended to represent a complete project but only a few transactions. These show the use of a hand-posted system, although little would change with the use of a computer accounting program. When using a computer accounting program that keeps a record of expenses, the Receipts Journal (S-96), Category Expense Sheet (S-90), and Accounts Sheet (S-26) may be computer generated. However, they should be in the same format as the forms provided by the branch office.

-

2. The sample contribution acknowledgment letter shows how contributions of $250 or more are acknowledged. The sample Receipts Journal shows how receipts are recorded and the totals are then posted each month to the sample Accounts Sheet. The sample Payment Voucher (S-94) and Petty Cash Reimbursement (S-95) form show how expenses are recorded and coded as payments are made. These amounts are then posted to the appropriate Category Expense Sheets. The totals from the Category Expense Sheets are then posted to the Accounts Sheet each month. The sample Loan/Receivable Ledger (S-92) illustrates how to keep a record of deposits receivable. A Loan/Receivable Ledger would also be completed for each individual who makes a loan to the project, but a sample has not been prepared since it is similar to the deposits receivable. The sample Monthly Report to Congregation —Kingdom Hall Building Fund (S-93) shows how the receipts and disbursements are consolidated and reported to the congregations.

ANYTOWN CONGREGATION OF JEHOVAH’S WITNESSES

111 Main Street, Anytown, XX 12345-6789 Tel: (123) 456-7891

Month, day, year

NAME

STREET ADDRESS

$XXX.XX

CITY STATE ZIP CODE

Dear:

Your kind contribution as indicated above was received on__The

congregation desires to thank you for your interest in the important work that your donation helps to support. Your contribution was received without any goods or services provided to you in return.

Proverbs chapter 3, verse 5, encourages us: “Trust in Jehovah with all your heart.” Certainly Jesus was a fine example of one who trusted in Jehovah. He actively carried on the public preaching campaign, confident that Jehovah would help him faithfully complete every aspect of his assigned ministry. Your contribution will assist in the important Bible education campaign that has been undertaken by Jehovah’s followers today.

We rejoice with you as the Word of God keeps on growing and an increasing number of individuals bear witness to the truth.—Acts 6:7.

Supporting Kingdom interests with you,

For the body of elders

THIS IS A SAMPLE ONLY AND SHOULD BE RETYPED USING CONGREGATION LETTERHEAD

ACCOUNTS SHEET

|

West Springfield NY February (Congregation or circuit) (City) (Province or state) (Month) |

2000 (Year) |

|

DATE |

TRANSACTION DESCRIPTION |

TC |

RECEIPTS |

CHECKING ACCOUNT |

OTHER: Petty Cash | |||||||||

|

IN |

OUT |

IN |

OUT |

IN |

OUT | |||||||||

|

2 |

Transfer to Petty Cash |

E |

500 |

— |

500 |

— | ||||||||

|

25 |

Interest on Checking |

570 |

43 | |||||||||||

|

27 |

Equipment Rental Deposit |

50 |

— | |||||||||||

|

27 |

Transfer to Petty Cash #124 |

E |

480 |

84 |

480 |

84 | ||||||||

|

28 |

Loans—Branch |

R |

250000 |

— | ||||||||||

|

28 |

Loans—Others |

R |

35000 |

— | ||||||||||

|

/I |

\ V | |||||||||||||

|

28 |

Donations |

R |

4465 |

— | ||||||||||

|

28 |

Transfers From Congregations |

R |

30000 |

— | ||||||||||

|

sjl | ||||||||||||||

|

28 |

Other—Equipment Deposit Returned |

R |

100 |

— | ||||||||||

|

t |

2 | |||||||||||||

|

28 |

Deposits to Checking |

319565 |

— |

319565 |

— | |||||||||

|

28 |

327—Fencing |

E |

2269 |

— |

398 |

— | ||||||||

|

28 |

722—Taxes |

E |

861 |

47 |

32 |

84 | ||||||||

|

28 |

466—Drywall |

E |

991 |

— | ||||||||||

|

28 |

460—Lumber (Rough) |

E |

3655 |

— | ||||||||||

|

28 |

462—Paint |

E |

3527 |

— | ||||||||||

|

TOTALS OF ALL COLUMNS @ |

319565 |

— |

319565 |

— |

320135 |

43 |

12284 |

31 |

980 |

84 |

480 |

84 | ||

S-26-E

1/06

|

DATE |

TRANSACTION DESCRIPTION |

TC |

RECEIPTS |

CHECKING ACCOUNT |

OTHER:_______________ | ||||||||||

|

IN |

OUT |

IN |

OUT |

IN |

OUT | ||||||||||

|

Totals Carried Forward | |||||||||||||||

|

“\ |

^3 | ||||||||||||||

|

\ | |||||||||||||||

|

I | |||||||||||||||

|

lb\ - | |||||||||||||||

|

TOTALS OF ALL COLUMNS @ | |||||||||||||||

|

J J | |||||||||||||||

|

REC Ba I ( I ( 7 CHE Ba I O I ( l A OTH Ba I O I TOT Not on s For |

ACCOUNTS SHEET RECONCILIATION FOR MONTH ENDING: _________2/29/00 EIPTS: Lance Forward $______L.______ N 319565+ |

1 O nstructions 3056.80 as of the Congregation 5LL0.00 |

C L |

OBLIGATIONS AT END OF MONTH URRENT: $ | |||||||||||

|

$_____________ $_____________ | |||||||||||||||

|

Ending Balance $___ If ending balance does not equal zero, see par. 10 of I or Congregation Accounting.) LCKING ACCOUNT: Lance Forward $ 5205 • 68 N 320135.43 + | |||||||||||||||

|

)UT AL i? :2 <3 4. ..3:1 | |||||||||||||||

|

Inding Balance lLLLLLl This amount is to equal the checkbook balance figur ast day of the month. See par. 13 of Instructions for Congregation Accounting.) [ER Petty Cash : Lance Forward $____0______ N 98CL. 8lL + |

TOTAL ONG TERM: _________________________________ $_____________ | ||||||||||||||

|

)UT <LiLLLL. 84 - | |||||||||||||||

|

Inding Balance ___ | |||||||||||||||

|

AL FUNDS ON HAND AT END OF MONTH $ 313556.80 |

- - | ||||||||||||||

|

e: The above “Ending Balance” amounts are to be written ucceeding month’s Accounts Sheet Reconciliation as “Balance ard” amounts. |

TOTAL | ||||||||||||||

Category Expense Sheet

Project Name West Congregation Category 327 Fencing

Month/Year February 2000 Budget Amount $15,000

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ 2,175.00 | |||

|

2/25/00 |

123 |

XYZ Building Supply |

Rebar |

875.00 |

3,050.00 | ||

|

2/25/00 |

123 |

XYZ Building Supply |

Wrought Iron Gates |

468.00 |

3,518.00 | ||

|

2/25/00 2/25/00 2/26/00 |

123 123 |

XYZ Building Supply XYZ Building Supply ABC Hardware |

Cement Block Grout Cement |

805.00 121.00 |

398.00 |

— |

4,323.00 4,444.00 4,842.00 |

|

— |

— | ||||||

|

- |

— |

— | |||||

|

— |

— | ||||||

|

Totals |

$ 2,269.00 |

$ 398.00 |

$ |

$ 4,842.00 | |||

Category Expense Sheet

Project Name West Congregation Category 722 Taxes

Month/Year February 2000 Budget Amount $16,500

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ 519.32 | |||

|

2/25/00 |

123 |

XYZ Building Supply |

Sales Tax |

861.47 |

1,380.79 | ||

|

2/26/00 |

ABC Hardware |

Sales Tax |

32.84 |

1,413.63 | |||

|

Totals |

$ 861.47 |

$ 32.84 |

$ |

$ 1,413.63 | |||

Category Expense Sheet

Project Name West Congregation Category 466 Drywall

Month/Year February 2000 Budget Amount $4,000

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ | |||

|

2/25/00 |

123 |

XYZ Building Supply |

Sheetrock |

786.00 |

786.00 | ||

|

2/25/00 |

123 |

XYZ Building Supply |

Drywall Screws |

15.00 |

801.00 | ||

|

2/25/00 |

123 |

XYZ Building Supply |

Mud |

150.00 |

951.00 | ||

|

2/25/00 |

123 |

XYZ Building Supply |

Drywall Tape |

40.00 |

991.00 | ||

|

Totals |

$ 991.00 |

$ |

$ |

$ 991.00 | |||

Category Expense Sheet

Project Name West Congregation Category 460 Lumber (rough)

Month/Year February 2000 Budget Amount $4,000

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ | |||

|

2/25/00 |

123 |

XYZ Building Supply |

Lumber |

3,655.00 |

3,655.00 | ||

|

Totals |

$ 3,655.00 |

$ |

$ |

$ 3,655.00 | |||

Category Expense Sheet

Project Name West Congregation Category Heating and Air-Conditioning

Month/Year February 2000 Budget Amount $15,000

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ | |||

|

2/15/00 |

Donated |

Air-Conditioning Unit |

10,000.00 |

10,000.00 | |||

|

Totals |

$ |

$ |

$ 10,000.00 |

$ 10,000.00 | |||

Category Expense Sheet

Project Name West Congregation Category 462 Paint

Month/Year February 2000 Budget Amount $10,000

|

Date |

Check # |

To Whom Paid |

Description of Item Purchased |

Checking |

Petty Cash |

Donated |

Cumulative |

|

Balance Carried Forward |

$ |

$ |

$ |

$ | |||

|

2/25/00 |

123 |

XYZ Building Supply |

Exterior Paint |

3,025.00 |

3,025.00 | ||

|

2/25/00 |

123 |

XYZ Building Supply |

Interior Paint |

502.00 |

3,527.00 | ||

|

Totals |

$ 3,527.00 |

$ |

$ |

$ 3,527.00 | |||

Loan/Receivable Ledger

No: _J30_____________

Name: Mason Recovery Telephone: ()

Address:______________________________________________________________________________________

Original Loan: $_____________________________ Date:______________ Interest:___________% per year

(If applicable)

Terms of repayment:_______________________________________________________________________

Record of Transactions:

|

Date |

Description |

In |

Out |

Balance |

|

1/20/00 |

Rental Deposit |

$ |

$ 100.00 |

$ 100.00 |

|

2/27/00 |

Rental Deposit |

$ |

$ 50.00 |

$ 150.00 |

|

2/28/00 |

Deposit Returned |

$ 100.00 |

$ |

$ 50.00 |

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ | |||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ | |||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

> \ \ |

$ |

$ |

$ | |

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ | ||

|

$ |

$ |

$ |

Monthly Report to Congregation Kingdom Hall Building Fund

Congregation West Number__12345______Month Ended 2/29/00

CASH IN THE BUILDING FUND BANK ACCOUNT

Cash in the bank at the beginning of the month $

Receipts during the month:

Donations received $4,465.00

Transfers from congregations 30,000.00

Loan from the branch 250,000.00

Loans from others 35,000.00

Other Interest, Depositreturned 670.43

5,205.68

(1)

Total received during the month

Cash available during the month (Line 1 plus line 2)

Disbursements during the month: (List or describe all major expenditures)

Materials 112,234.13

Rental Deposit 50.00

320,1,35.4,3

325,341.11

(2)

(3)

(5)

|

PROJECT TOTAL FUNDING STATUS | |||

|

Total estimated cost of the project |

$_____ |

325,000.00 |

— (a) |

|

Funds received to date: Donations received $_____ Transfers from congregations ______ Loan from the branch _____ Loans from others _____ Sale of Kingdom Hall _____ Other Interest, Depositreturned _____ Total funds received to date |

_________7,465.00 35,000.00 250,000.00 35,000.00 ____________670.43 |

328,135.43 |

— (b) |

|

Funds to be received in the future: Loan from the branch _____ Loans promised by others _____ Expected proceeds-Sale of Hall _____ Other _____ Total funds to be received in the future |

0.00 |

— (c) | |

|

REQUIRED TO COMPLETE THE PROJECT (Line a minus |

lines b and c) $______ |

(3,135.43) |

— (d) |

121,284.11

313,056.80

Total disbursements for the month

Cash in bank at the end of the month (Line 3 minus line 4) $

(4)

Payment Voucher

Building Project West Coiigivgiilion, Spong'ielT NY____________________________________________

Check Number 123___________________Date 2/25/00

Paid to: XY/BuildingSupply__________________________________________________________________

Prepared by:

Approved by:_____________________________________

|

Item |

Cost Element |

Amount |

|

Rebar - Fencing |

327 |

875.00 |

|

Sheetrock |

466 |

786.00 |

|

Drywall Screws |

466 |

15.00 |

|

Mud |

466 |

150.00 |

|

Drywall Tape |

466 |

40.00 |

|

Lumber - Framing |

460 |

3,655.00 |

|

Paint - Interior |

462 |

502.00 |

|

Paint - Exterior |

462 |

3,025.00 |

|

Wrought Iron Gates |

327 |

468.00 |

|

Cement Block |

327 |

805.00 |

|

Grout |

327 |

121.00 |

|

Sub-total |

10,442.00 | |

|

Tax |

722 or 140 |

861.47 |

|

Total amount of check |

11,303.47 |

Regional Building Committee Approval:_________________________________________________

PETTY CASH REIMBURSEMENT

RECEIPTS JOURNAL Kingdom Hall Building Fund

Congregation____^esl_________________________________________________ Congregation Number__12345_________ Month/Year February -()()()

|

Date |

Receipt No. |

Description |

Loans Branch |

Loans Other |

Donations |

Transfers From Congregation Cash |

Other |

Totals-In |

Totals-Out | ||||||||||||

|

$ |

$ |

$ |

$ |

$ |

$ |

$ | |||||||||||||||

|

2/3/00 |

1 |

Donations |

250 |

00 |

250 |

00 | |||||||||||||||

|

2/8/00 |

2 |

Congregation X |

10,000 |

00 |

10,000 |

00 | |||||||||||||||

|

2/9/00 |

3 |

West Congregation |

12,000 |

00 |

12,000 |

00 | |||||||||||||||

|

2/10/00 |

Deposit to checking |

22,250 |

00 | ||||||||||||||||||

|

2/11/00 |

4 |

Congregation Y |

8,000 |

00 |

8,000 |

00 | |||||||||||||||

|

2/15/00 |

5 |

Loan from the branch |

250,000 |

00 |

100 |

00 |

250,100 |

00 | |||||||||||||

|

2/16/00 |

6 |

Donations |

65 |

00 |

65 |

00 | |||||||||||||||

|

2/17/00 |

7 |

Brother A |

15,000 |

00 |

600 |

00 |

15,600 |

00 | |||||||||||||

|

2/17/00 |

Deposit to checking |

273,765 |

00 | ||||||||||||||||||

|

2/19/00 |

8 |

Brother B |

20,000 |

00 |

20,000 |

00 | |||||||||||||||

|

2/20/00 |

9 |

Donations |

885 |

00 |

\ |

885 |

00 | ||||||||||||||

|

2/24/00 |

10 |

Donations |

TV |

00 |

90 |

00 | |||||||||||||||

|

2/24/00 |

Deposit to checking |

20,975 |

00 | ||||||||||||||||||

|

2/24/00 |

11 |

Donations |

200 |

00 |

200 |

00 | |||||||||||||||

|

2/25/00 |

12 |

Donations |

700 |

00 |

700 |

00 | |||||||||||||||

|

2/25/00 |

13 |

Donations |

450 |

00 |

450 |

00 | |||||||||||||||

|

2/27/00 |

14 |

Donations |

1,125 |

00 |

1,125 |

00 | |||||||||||||||

|

2/28/00 |

15 |

Equipment deposit returned |

100 |

00 |

100 |

00 | |||||||||||||||

|

2/28/00 |

Deposit to checking |

2,575 |

00 | ||||||||||||||||||

|

\ S | |||||||||||||||||||||

|

PAGE TOTALS |

$ 250,000 |

00 |

$ |

35,000 |

00 |

$ |

4,465 |

00 |

$ 30,000 |

00 |

$ |

100 |

00 |

$ |

319,565 |

00 |

$ |

319,565 |

00 | ||

S-96-E 9/02